Materials

Materials

Summary

Modern vehicle structures are designed using a diverse range of materials, including steels, aluminum alloys, magnesium alloys, polymers, and composites, frequently employed in hybrid configurations. Material selection is a complex process driven by structural requirements, manufacturing considerations, and cost. Steels, such as mild, high-strength, and advanced high-strength steels, remain fundamental due to their versatility and cost-effectiveness. Aluminum and magnesium alloys are crucial for lightweighting initiatives, offering excellent strength-to-weight ratios and corrosion resistance, though magnesium faces challenges like lower ductility and corrosion susceptibility. Polymers provide design flexibility and cost-efficiency for components like interior trim, with thermoplastics being recyclable unlike thermosets. Composites, particularly Carbon Fiber Reinforced Polymers (CFRP), deliver exceptional strength-to-weight benefits but come with higher costs and recycling complexities. The Ashby methodology systematically guides material selection using a merit index to balance performance, cost, and environmental impact. Electric vehicles introduce reliance on critical rare earth elements like Neodymium and Dysprosium for high-performance motors, posing supply chain challenges due to concentrated production and price volatility. The automotive industry is increasingly adopting multi-material designs and sustainable materials to achieve lighter, more efficient, and safer vehicles.

Learning Objectives

Identify key materials used in vehicle structures and their properties.

Compare mechanical, chemical, and economic characteristics of automotive materials.

Understand manufacturing processes for different automotive materials.

Evaluate material selection criteria for vehicle components.

Recognize emerging trends in automotive material technology.

Introduction to Automotive Materials

Modern vehicle structures utilize a variety of materials selected based on structural requirements, manufacturing considerations, and cost. The primary materials include steels, aluminum alloys, magnesium alloys, polymers, and composites, often used in hybrid configurations.

| Materials used in conventional and electric vehicles (EVs). Material Category | Common Materials | Primary Uses in Vehicles |

|---|---|---|

| Metals & Alloys | Steel (Mild, HSLA, AHSS) | Body frame, chassis, engine blocks, wheels |

| Aluminum | Aluminum alloys | Body panels, engine parts, battery enclosures (EVs) |

| Magnesium | Magnesium alloys | Dashboard cross braces, steering wheels, transmission cases |

| Copper | Copper wiring | Wiring, electric motors, battery systems (EVs) |

| Titanium | Titanium alloys | Exhaust systems, high-performance components |

| Lithium (Li) | Lithium-ion compounds | Critical for EV energy storage |

| Nickel (Ni) | NMC, NCA cathodes | Batteries (EVs), stainless steel components |

| Cobalt (Co) | Cobalt-based cathodes | Battery cathodes (EVs), high-cost |

| Rare Earth Metals (Nd, Dy) | Neodymium, Dysprosium | Permanent magnets in EV motors |

| Plastics | Polypropylene (PP) | Bumpers, interior trim, battery casings |

| Polyurethane (PU) | PU foam | Seats, insulation, cushioning |

| Composites | Carbon Fiber (CFRP) | Roof panels, hoods, structural parts |

| Glass | Laminated/Tempered | Windshields, side/rear windows |

| Rubber | Natural/Synthetic | Tires, seals, hoses |

| Fluids | Engine oil, Coolant | Lubrication, thermal management |

| Battery Electrolyte | LiPF₆ | Conducts ions in EV batteries |

| Other | Leather, Ceramics | Seats, spark plugs, insulation |

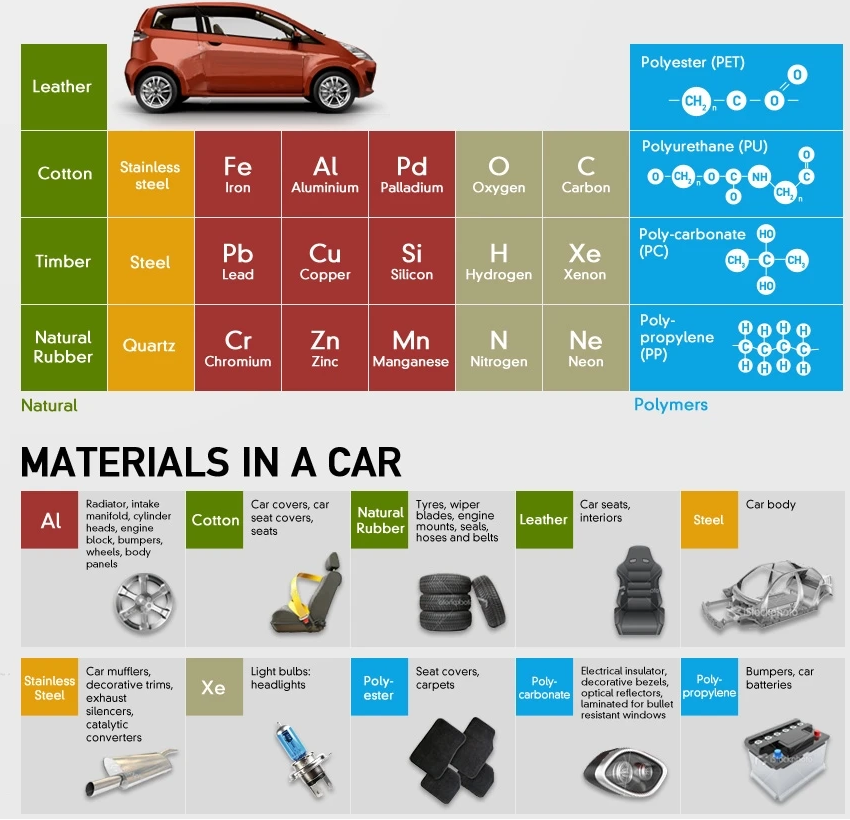

An infograph of materials used to produce a car .

An infograph of materials used to produce a car .

Major Materials

Steel

Steel remains a fundamental material in automotive manufacturing due to its versatility, strength, and cost-effectiveness. The main types used in vehicles include:

Mild Steel: A low-cost option with good formability (140–180 MPa yield strength), commonly used in non-critical structural components where weight is not a primary concern.

High-Strength Steel (HSS): Offers higher strength (180–300 MPa yield) while maintaining reasonable formability, making it suitable for load-bearing parts like chassis reinforcements.

Advanced High-Strength Steel (AHSS): Provides exceptional strength (300–1200 MPa yield) with optimized weight savings, used in safety-critical areas such as crumple zones and B-pillars for crash protection.

Stainless Steel: Highly corrosion-resistant but more expensive, typically reserved for exhaust systems, trim, and high-end components where durability is prioritized.

Aluminum Alloys

Aluminum alloys are widely used in automotive manufacturing due to their lightweight properties, corrosion resistance, and strength. The most common series include:

5xxx Series (Al-Mg alloys): Primarily used for internal panels and structural components due to their excellent formability, weldability, and corrosion resistance. These alloys are ideal for non-load-bearing parts where durability is key.

6xxx Series (Al-Mg-Si alloys): Preferred for outer body panels (doors, hoods, fenders) because they balance strength and formability while allowing for heat treatment to enhance mechanical properties. Their good surface finish makes them suitable for painting.

7xxx Series (Al-Zn alloys): The strongest aluminum alloys, often used in high-stress structural components like crash rails and suspension parts. While they offer superior strength, they are less corrosion-resistant than 5xxx and 6xxx alloys and often require protective coatings.

Magnesium Alloys

Magnesium alloys are the lightest structural metals available, offering a 35% weight reduction compared to aluminum, making them highly attractive for automotive lightweighting initiatives. These alloys are primarily used in cast components due to their excellent castability and high strength-to-weight ratio.

Common magnesium alloys include AZ91 (Mg-Al-Zn), AM60, and AM50 (Mg-Al-Mn), which provide a balance of mechanical properties and corrosion resistance.

Meaning:

First Letter (A, Z, M): Indicates the main alloying elements (Al, Zn, Mn).

Numbers (91, 60, 50): Represent the percentage of the primary alloying element (e.g., 9% Al in AZ91).

Trade-offs:

AZ91 = Strongest but less ductile.

AM60/AM50 = More ductile but slightly weaker (better for crash-relevant parts).

Key automotive applications include:

Instrument panel supports (reducing weight in the front upper body structure)

Transmission cases (lowering powertrain mass)

Steering wheels, seat frames, and engine brackets (where weight savings are critical)

Despite their advantages, magnesium alloys face challenges such as lower ductility, flammability during processing, and corrosion susceptibility, requiring protective coatings or careful alloy modifications. However, ongoing research into new alloy formulations and improved anti-corrosion treatments is expanding their use in next-generation vehicles.

Why It Matters:

By incorporating magnesium alloys, automakers can significantly reduce vehicle weight, improving fuel efficiency and emissions performance without compromising structural integrity. Their growing adoption highlights the industry’s shift toward advanced lightweight materials in pursuit of stricter regulatory standards and enhanced sustainability.

| Common Automotive Magnesium Alloys Alloy | Composition | Key Properties | Primary Automotive Applications | Trade-offs |

|---|---|---|---|---|

| AZ91 | Mg-9%Al-1%Zn | High strength, good castability, moderate corrosion resistance | Transmission cases, engine components, structural parts | Less ductile than AM series, may require corrosion coatings |

| AM60 | Mg-6%Al-0.3%Mn | Better ductility than AZ91, good impact resistance, moderate strength | Steering wheels, seat frames, safety-critical parts | Slightly weaker than AZ91, lower corrosion resistance than coated AZ91 |

| AM50 | Mg-5%Al-0.3%Mn | Higher ductility than AM60, good formability, moderate strength | Instrument panels, interior trim, non-load-bearing parts | Lower strength than AM60/AZ91, limited to low-stress applications |

Polymers

Polymers are widely used in automotive manufacturing due to their lightweight properties, design flexibility, and cost-effectiveness. They are broadly classified into two categories: thermoplastics and thermosets.

Thermoplastics (e.g., polypropylene (PP), acrylonitrile butadiene styrene (ABS), polycarbonate (PC)) can be repeatedly melted and reshaped, making them ideal for recyclable components such as bumpers, interior trim, and dashboards. Their ease of processing allows for complex geometries and efficient mass production.

Thermosets (e.g., epoxies, polyurethanes), once cured, undergo an irreversible chemical reaction, resulting in a rigid, heat-resistant structure. These materials are used in high-temperature applications like electrical insulation, adhesives, and composite matrices. While they offer superior durability, they cannot be remelted or recycled like thermoplastics.

Composites

Composite materials are revolutionizing automotive design by offering exceptional strength-to-weight ratios, corrosion resistance, and design flexibility. Glass Fiber Reinforced Polymers (GFRP) provide a cost-effective solution for semi-structural components like body panels, bumper beams, and interior parts, combining moderate strength with good impact resistance at lower costs than traditional metals. Carbon Fiber Reinforced Polymers (CFRP), though more expensive, deliver superior stiffness and lightweight properties, making them ideal for high-performance applications such as chassis components, roof panels, and electric vehicle battery enclosures. Both composites enable significant weight reduction—critical for improving fuel efficiency and extending EV range—while allowing complex geometries that are difficult to achieve with metals. However, challenges like recyclability, high manufacturing costs (especially for CFRP), and repair complexities remain key focus areas for wider adoption in mass-market vehicles. Advances in hybrid composites (e.g., carbon-glass hybrids) and sustainable resin systems are driving their increased use across the automotive industry.

| Key Material Properties for Automotive Applications Property | Steel | Al | Mg | Poly. | Comp. |

|---|---|---|---|---|---|

| Density (g/cm\(^3\)) | 7.8 | 2.7 | 1.7 | 0.9–1.5 | 1.2–2.0 |

| Yield Str. (MPa) | 140–1200 | 100–260 | 80–200 | 20–100 | 150–1200 |

| Modulus (GPa) | 210 | 70 | 45 | 0.5–5 | 10–250 |

| Formability | Good | Exc. | Fair | Exc. | Poor |

| Corrosion | Poor | Good | Poor | Exc. | Exc. |

| Cost ($/kg) | 0.5–1.5 | 2–4 | 3–5 | 1–5 | 5–50+ |

| Recycling | Exc. | Good | Fair | Poor | Fair |

Note: Steel dominates due to good properties/cost balance. Al=Aluminum, Mg=Magnesium, Poly.=Polymers, Comp.=Composites, Exc.=Excellent, Str.=Strength

Material Selection

Selection criteria

| Selection Criteria for Automotive Materials Criterion | Considerations and Ashby Methods |

|---|---|

| Functional Requirements |

- Mechanical: \(_y\), \(E\), toughness

- Thermal: \(T_{melt}\), \(\), \(\)

- Lightweighting: \(\) optimization via \(E^{1/3}/\)

Manufacturing |

- Formability (stamping/casting)

- Joinability (welding/adhesives)

- Cost: material + processing

Performance Indices |

- Stiffness-weight: \(E^{1/2}/\) (panels)

- Strength-weight: \(_y/\) (crash)

- Thermal stress: \(_y/(E)\) (exhaust)

Durability |

- Corrosion/wear resistance

- Recyclability (thermoplastics \(\))

Economic Factors |

- Material availability

- Safety regulations

- LCA considerations

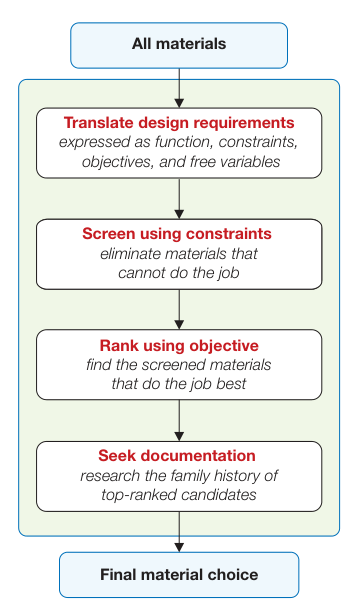

Selection Methodology

The process follows Ashby’s four-stage approach:

Translation: Convert design requirements to material properties

Screening: Eliminate materials failing constraints

Ranking: Apply performance indices

Documentation: Study top candidates in depth

The selection of materials for automotive components follows Ashby’s systematic methodology, balancing competing demands through merit indices.

\[\[\begin{equation} \text{Merit Index}=\frac{\text{Performance}}{\text{Cost}\times\text{Environmental Impact}} \end{equation}\]\]

Definition of Merit Index

The merit index proposed by Ashby provides a quantitative measure for material selection:

\[\[\begin{equation} M=\frac{P}{C\times E} \end{equation}\]\]

where:

\(P\) = Performance metric (dimensionless)

\(C\) = Cost factor (normalized units)

\(E\) = Environmental impact (normalized units)

Component Definitions

- Performance (P)

The performance metric combines relevant material properties for the specific application. For structural components, this is typically expressed as:

\[\[\begin{equation} P=\frac{\sigma_{y}^{n}}{\rho}\quad\text{or}\quad P=\frac{E^{1/2}}{\rho} \end{equation}\]\]

where \(_{y}\) is yield strength, \(E\) is Young’s modulus, \(\) is density, and \(n\) is an exponent between 1 and 2 depending on loading conditions.

Cost (C)

The cost factor includes:

Raw material costs ($/kg)

Manufacturing costs (forming, joining, finishing)

Lifecycle costs (maintenance, repair)

Environmental Impact (E)

Environmental impact considers:

Embodied energy (MJ/kg)

Carbon footprint (kg \(CO_{2}\) per kg)

Recyclability factor (0 to 1 scale)

Example Applications

Case Study: Body Panels

Case Study: Body Panels (Advanced Application)

Consider the selection of materials for an automotive door panel:

Aluminum 6061:

Performance: \(P_{Al}=50\)

Cost: \(C_{Al}=2\)

Environmental Impact: \(E_{Al}=3\)

Merit Index: \(M_{Al}==8.3\)

Carbon Fiber Reinforced Polymer (CFRP):

Performance: \(P_{CFRP}=80\)

Cost: \(C_{CFRP}=8\)

Environmental Impact: \(E_{CFRP}=6\)

Merit Index: \(M_{CFRP}==1.7\)

Key Insights

The merit index reveals that while CFRP offers superior mechanical performance (higher \(P\)), its significantly higher cost and environmental impact result in a lower overall merit index compared to aluminum. This explains why aluminum remains prevalent in mass-produced vehicles despite CFRP’s technical advantages.

Limitations

Requires careful normalization of all parameters

Assumes linear relationships between factors

Environmental impact metrics may vary regionally

Does not account for manufacturing constraints

Critical Rare Earth Elements in Electric Vehicles

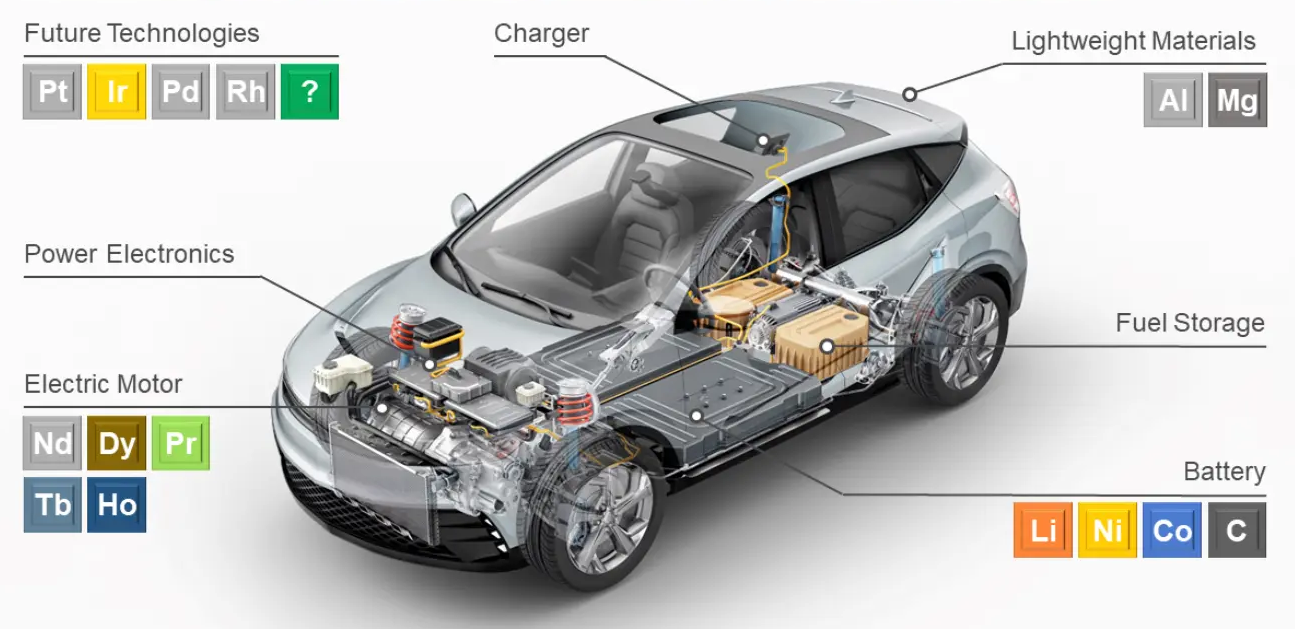

Table 1.5 presents a comprehensive list of materials grouped by functional type. Figure 1.3 shows the use of rare earth elements (RRE) in electric vehicles.

| Critical Raw Materials Classification Material Category | Materials | Key Automotive Applications |

|---|---|---|

| Metals & Alloys | Steel, Aluminum (Al), Copper (Cu), Magnesium (Mg), Zinc (Zn), Lead (Pb), Nickel (Ni), Tin (Sn), Cobalt (Co), Tungsten, Molybdenum (Mo) | Body structures (steel, aluminum), wiring (copper), battery components (nickel, cobalt), lightweight components (magnesium) |

| Rare Earth Elements | Neodymium (Nd), Dysprosium (Dy), Praseodymium (Pr), Terbium (Tb) | Permanent magnets in motors, battery additives, sensors and electronics |

| Platinum Group Metals | Platinum (Pt), Palladium (Pd), Rhodium (Rh) | Catalytic converters, fuel cell components |

| Battery Materials | Lithium (Li), Graphite (C), Manganese (Mn), Cobalt (Co), Nickel (Ni) | Lithium-ion batteries, anode/cathode materials |

| Other Critical Materials | Silicon (Si), Rubber, Plastics, Glass | Electronics (silicon), tires (rubber), interior components (plastics) |

Rare earth elements in EVs.

Rare earth elements in EVs.

- Neodymium (Nd)

Neodymium serves as the foundational element for high-performance permanent magnets in electric vehicle motors, specifically in neodymium-iron-boron (NdFeB) magnet formulations. These magnets exhibit exceptional magnetic properties, including a high energy product of approximately 50 MG.Oe and a Curie temperature of 310 \(C^{0}\), enabling compact, high-torque density motor designs. Typical EV applications require 1-2 kg of neodymium per 100 kw of motor power, making it one of the most strategically important rare earths in electrified transportation.

Dysprosium (Dy)

Dysprosium plays a critical role as a thermal stabilizer in NdFeB magnets, typically comprising 3-6% of the magnet’s weight. Its primary function involves maintaining magnetic performance at elevated operating temperatures, preventing demagnetization in conditions exceeding 150 \(C^{0}\) that commonly occur in high-performance EV drivetrains. This temperature stabilization comes at a premium, as dysprosium is among the rarest and most expensive rare earth elements.

Praseodymium (Pr)

Praseodymium functions as a partial substitute for neodymium in magnet formulations, creating PrFeB magnets with marginally reduced magnetic properties. Current engineering practice employs hybrid Nd/Pr magnet formulations to optimize cost and performance trade-offs. While praseodymium-based magnets exhibit approximately 10-15% lower energy products than their neodymium counterparts, they provide valuable supply chain diversification benefits.

Lanthanum (La)

Lanthanum historically served as a key component in nickel-metal hydride (NiMH) battery cathodes due to its exceptional hydrogen storage capacity. While some hybrid vehicles still utilize this technology, the automotive industry has largely phased out lanthanum-containing batteries in favor of lithium-ion systems. Current applications focus primarily on exhaust gas treatment systems in vehicles with internal combustion engines.

Cerium (Ce)

Cerium contributes significantly to catalytic converter formulations, including those used in range-extended electric vehicles. Its oxygen storage capacity and redox properties enable efficient conversion of exhaust pollutants, even under fluctuating air-fuel ratios. Modern three-way catalysts may contain up to 50% cerium oxide by weight, though EV adoption is gradually reducing demand for this application.

Yttrium (Y)

Yttrium is gaining importance in next-generation solid-state battery development, where it stabilizes zirconia-based electrolytes through its high ionic conductivity. When doped into ceramic electrolytes, yttrium enables lithium-ion transport while maintaining structural stability at operating temperatures exceeding 100 \(C^{0}\). This makes it particularly valuable for high-performance battery applications.

Terbium (Tb)

Terbium exhibits extraordinary magnetostrictive properties, with potential applications in advanced sensor systems for vehicle dynamics monitoring. The “giant magnetostriction” effect allows for precise measurement of mechanical stresses through magnetic field variations. While not yet widely deployed in production vehicles, terbium-containing materials show promise for future smart suspension and torque measurement systems.

Supply Chain Considerations

The global supply chain for rare earth elements (REEs) critical to electric vehicles faces significant challenges, including extreme geographic concentration (with China controlling over 80% of production and processing), price volatility due to geopolitical factors, and complex extraction/refining requirements that create environmental concerns. These supply chain vulnerabilities are particularly acute for neodymium and dysprosium used in permanent magnet motors, where demand is projected to grow 300-400% by 2030, potentially outstripping current production capacity. Automotive manufacturers are responding through three key strategies: developing Dy-free magnet formulations (Dy-free magnet formulations, specifically Dy-free Nd-Fe-B magnets, are developed to reduce or eliminate the need for dysprosium) to reduce reliance on the most critical REEs, establishing direct partnerships with mining operations in Australia and North America to diversify supply sources, and implementing closed-loop recycling systems to recover REEs from end-of-life vehicles and manufacturing scrap. These measures aim to mitigate risks while meeting the exponential growth in demand from electrification, though significant challenges remain in achieving price stability and sustainable sourcing, particularly as EV adoption accelerates globally.

Emerging Trends

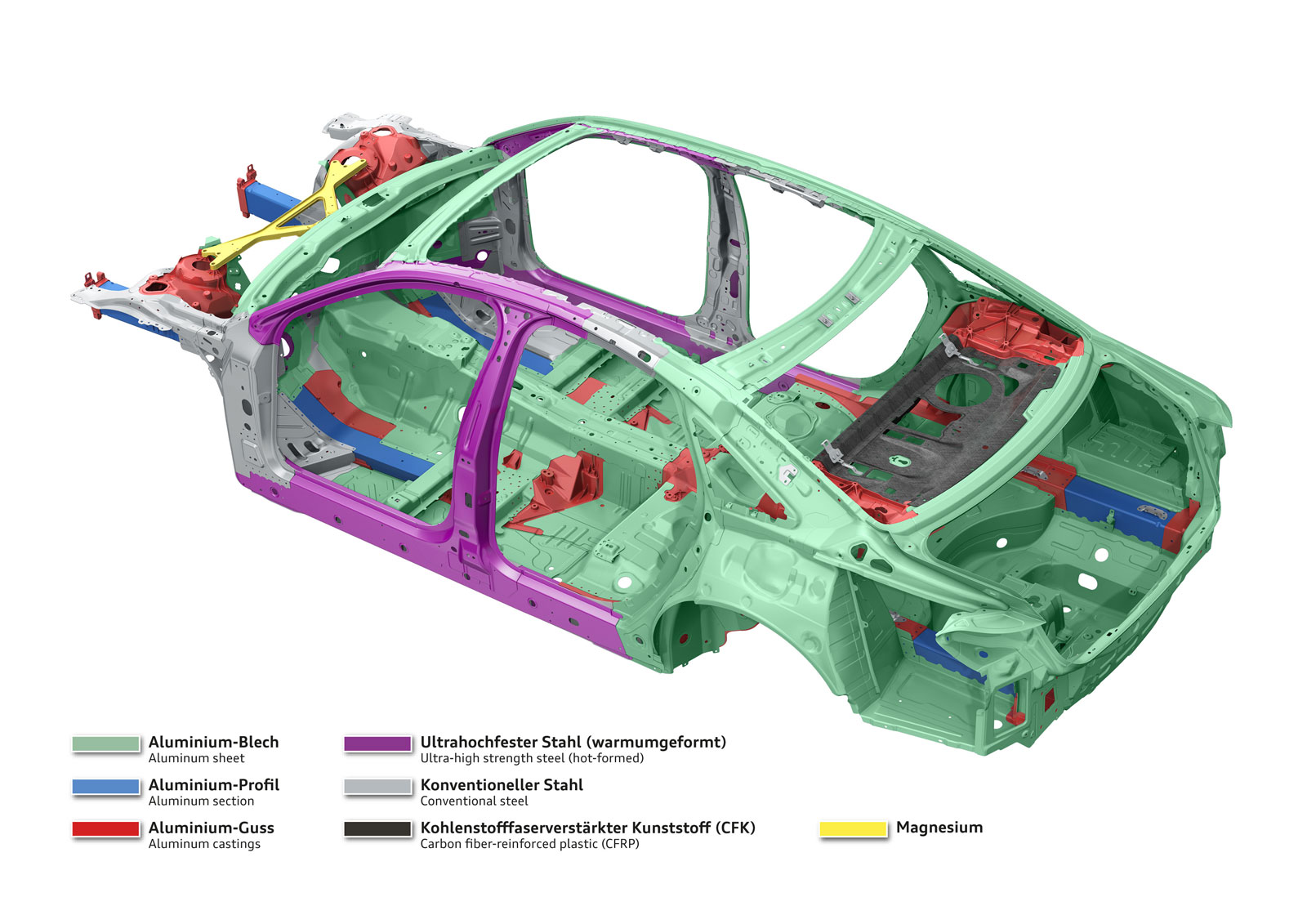

The automotive manufacturing industry is rapidly evolving with new trends focused on lightweight, sustainable, and high-performance vehicle structures. Manufacturers are increasingly adopting multi-material designs that combine advanced high-strength steels, aluminum space frames, and advanced composites like carbon fiber to optimize strength, safety, and efficiency. Additionally, the shift toward sustainable materials, including recycled metals and bio-based composites, reflects the industry’s commitment to reducing environmental impact while maintaining structural integrity. These innovations enable lighter, more fuel-efficient vehicles without compromising safety or performance—a key priority for next-generation luxury and high-performance cars.

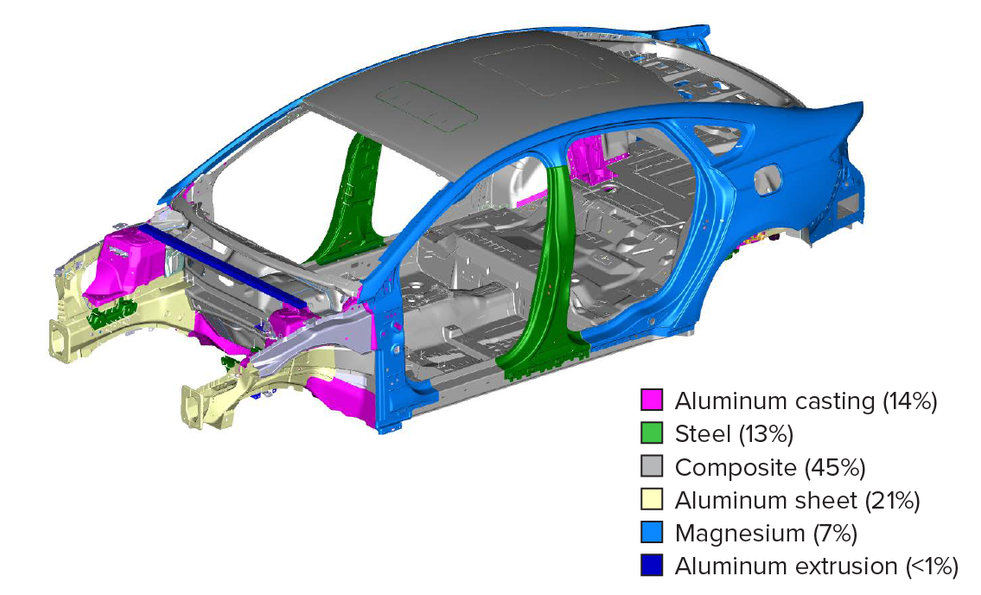

The fourth-generation Audi A8 luxury sedan introduces an advanced multi-material space frame construction, combining aluminum (58%), high-strength steel (14%), magnesium (2%), and carbon fiber reinforced polymer (2%) to optimize strength and weight. Key innovations include press-hardened steel B-pillars for crash protection, hybrid aluminum components, magnesium in the dashboard cross brace, and CFRP in the rear panel and transmission tunnel. Audi employs 14 advanced joining techniques, such as laser welding and structural bonding, alongside new aluminum casting technologies for complex geometries and improved corrosion resistance. This design enhances performance with a 51% increase in torsional stiffness, 15kg weight savings in critical components, and superior crash protection, marking a significant engineering milestone in lightweight vehicle construction.

Audi A8 multi-material space frame structure showing material distribution and key components (Image: Audi AG)

Audi A8 multi-material space frame structure showing material distribution and key components (Image: Audi AG)  Different materials in vehicle body.

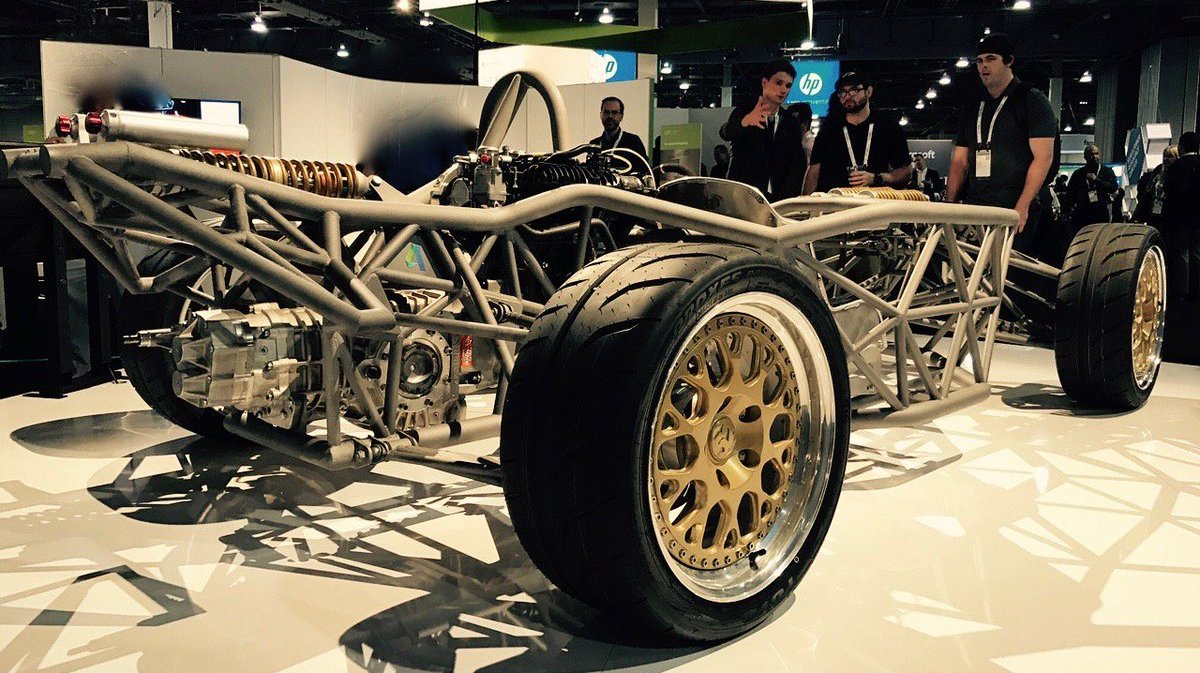

Different materials in vehicle body.  3D printed frame.

3D printed frame.